Is your financial data really safe? Banks and financial companies rely on online systems, but hackers always look for ways to break in. One of the biggest weak spots is APIs (Application Programming Interfaces)—the systems that connect different banking services.

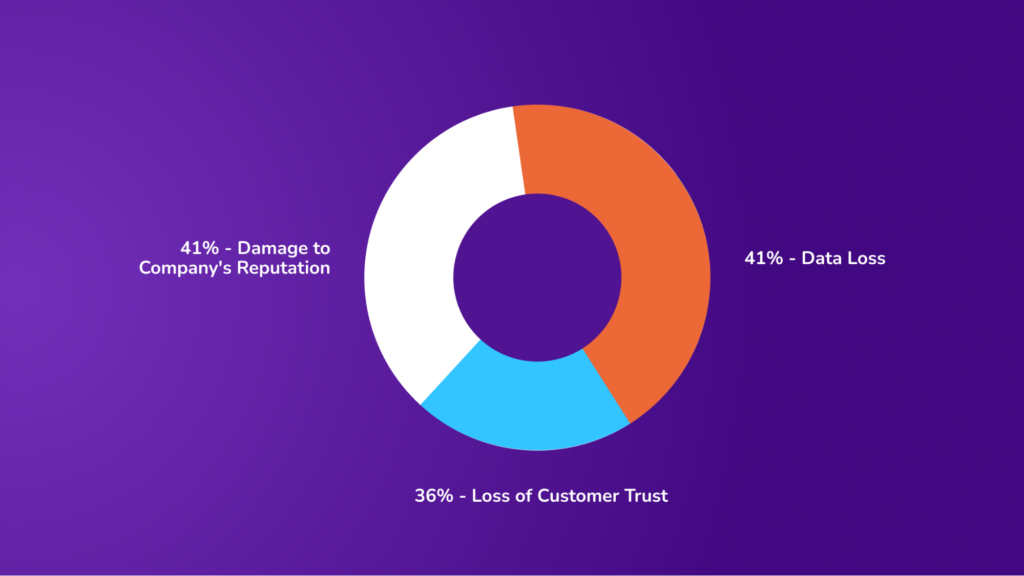

Studies show that 41% of API breaches cause data loss and damage a company’s reputation, 36% lead to financial losses, and 35% make customers leave.

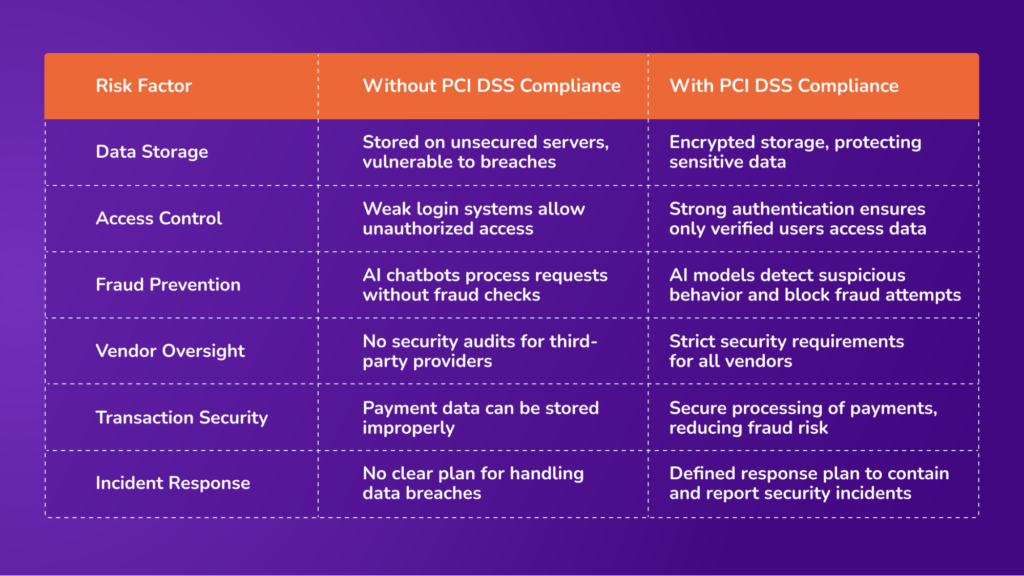

Many banks now use AI chatbots to handle customer requests, check account details, and even process transactions. However, if these chatbots are not PCI-compliant, they can expose credit card data, leading to massive fines and lost trust.

Protecting customer information is necessary. This blog will explain why AI chatbots need PCI DSS compliance and how banks can keep data safe using automation.

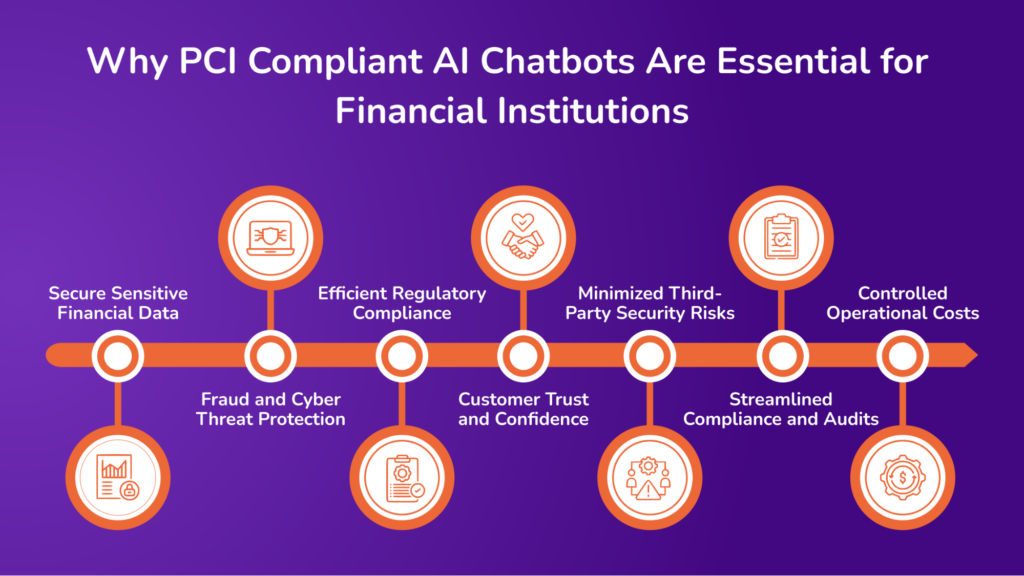

Why PCI Compliant AI Chatbots Are Essential for Financial Institutions

Here’s why financial institutions must implement AI chatbots that meet PCI DSS compliance standards:

Secure Sensitive Financial Data

Financial firms handle vast amounts of confidential data daily. This includes credit card details, personal IDs, and banking records. Every transaction, inquiry, and customer chat generates more data. Without strict security, this data can be stolen, misused, or sold on the dark web.

AI chatbots that lack PCI DSS compliance may store or process this data in unsafe ways, increasing the risk of breaches.

PCI DSS compliance ensures that AI chatbots follow the highest security measures. It sets strict rules for processing, storing, and transmitting credit card details. It prevents unauthorized access by using encryption, secure networks, and regular security checks.

For example, when a customer shares card details with a bank’s chatbot, PCI DSS rules ensure the data is masked, encrypted, and stored securely.

But compliance alone is not enough. Financial firms must also train AI models to detect and block fraud attempts. Attackers often try to manipulate chatbots to reveal sensitive data. An intelligent, compliant chatbot must refuse unauthorized requests and alert security teams of unusual activities.

Financial institutions must choose AI chatbots that are built with security-first principles.

Fraud and Cyber Threat Protection

Fraudsters constantly look for ways to trick customers into revealing sensitive data. If not properly secured, AI chatbots can become a gateway for phishing attacks, account takeovers, and identity theft. Attackers often impersonate chatbots, send fake links, or intercept conversations to steal user data.

PCI-compliant chatbots help prevent fraud by using:

- End-to-end encryption: This ensures that outsiders can’t read sensitive messages.

- Strict authentication steps: Chatbots can require passwords, OTPs, or biometric data before processing requests.

- Real-time fraud detection: AI can analyze patterns and detect suspicious activities. For example, the chatbot can flag a user’s sudden request for multiple card details or unusual questions as fraud.

For instance, a scammer contacts a customer, pretending to be a bank chatbot. They ask the user to “verify their account” by entering their credit card details. If the chatbot follows PCI DSS rules, it will recognize this as a phishing attempt and refuse to process the request. It may even alert the bank’s security team.

Financial fraud has real costs. Data breaches can lead to huge penalties, loss of customer trust, and damaged reputations.

Efficient Regulatory Compliance

Compliance plays a critical role in the financial sector. Failing to meet data security requirements can lead to regulatory fines, legal challenges, and potential impacts on licensing. Here are some of the regulations financial institutions are expected to follow:

Regulations include:

- PCI DSS (Payment Card Industry Data Security Standard): Sets strict security rules for handling card transactions.

- GDPR (General Data Protection Regulation – Europe): Requires banks to protect customer data and allow users to control their own information.

- CCPA (California Consumer Privacy Act – USA): Gives consumers more rights over their data and holds companies accountable for breaches.

Banks and financial firms that use non-compliant AI chatbots risk violating these regulations. This can result in multimillion-dollar fines and legal trouble.

Financial firms should regularly audit their AI chatbots to ensure ongoing compliance. PCI DSS rules evolve, and firms must update their systems to stay secure. A single compliance failure can cost millions.

Customer Trust and Confidence

Trust is the foundation of the financial industry. Clients expect their banks and financial service providers to safeguard their assets and personal information. A single security breach can erode that trust—and often, it’s enough to send customers to a competitor.

Security becomes even more critical as AI chatbots become more integrated into digital banking experiences. Customers want assurance that their data is protected, their identities are secure, and their financial information is handled with the utmost care.

PCI DSS compliance provides that assurance. It ensures AI chatbots adhere to rigorous data security standards—encrypting sensitive information, preventing unauthorized access, and actively mitigating fraud risk. For users, this translates into safer, more trustworthy interactions, even during something as routine as checking an account balance.

Consumers are more informed—and more cautious—in today’s environment about cybersecurity. They expect secure, transparent digital experiences. An AI chatbot that meets PCI DSS requirements sends a clear signal: the institution prioritizes customer safety and regulatory responsibility.

Minimized Third-Party Security Risks

Financial institutions rely on multiple vendors for technology, data storage, and customer support. Every third-party provider that handles customer data introduces a new risk. A vendor with weak security can become a backdoor for cybercriminals. PCI compliance helps financial firms work only with trusted vendors that meet strict security standards.

Here’s how PCI DSS-compliant AI chatbots reduce third-party security risks:

Banks and financial firms must assess vendor security before integrating their services. A weak link in the supply chain can lead to massive data leaks. PCI-compliant AI chatbots ensure that transactions and customer data remain secure even when third-party providers are involved.

Streamlined Compliance and Audits

Regulators require financial institutions to prove they meet security standards. PCI DSS compliance simplifies this process. Instead of manually tracking security measures, AI-driven systems automate compliance reporting, ensuring all activities are logged and auditable.

Non-compliant AI chatbots can significantly complicate regulatory audits. Incomplete or missing security records may expose financial institutions to fines, reputational damage, or even the loss of operating licenses.

In contrast, a PCI DSS-compliant AI chatbot maintains comprehensive logs of every interaction, transaction, and security-related event. This level of documentation enables institutions to generate audit-ready reports quickly and demonstrate compliance with regulatory requirements.

For example, if an auditor requests evidence that customer credit card data was handled securely, a compliant system can produce a detailed report within seconds. Without this level of visibility, firms may struggle to prove adherence to security standards—potentially triggering time-consuming and costly investigations.

Using a PCI-compliant AI chatbot also helps reduce the risk of human error in compliance reporting. Automated logging and audit capabilities ensure that security protocols are consistently followed, easing the workload for internal compliance teams.

As AI continues to reshape the financial sector, robust compliance frameworks are essential. AI-driven reporting strengthens security and frees institutions to focus on innovation and growth.

When fully adopted, generative AI has the potential to contribute an estimated $200 billion to $340 billion annually to the banking industry, underscoring the importance of secure, compliant AI systems.

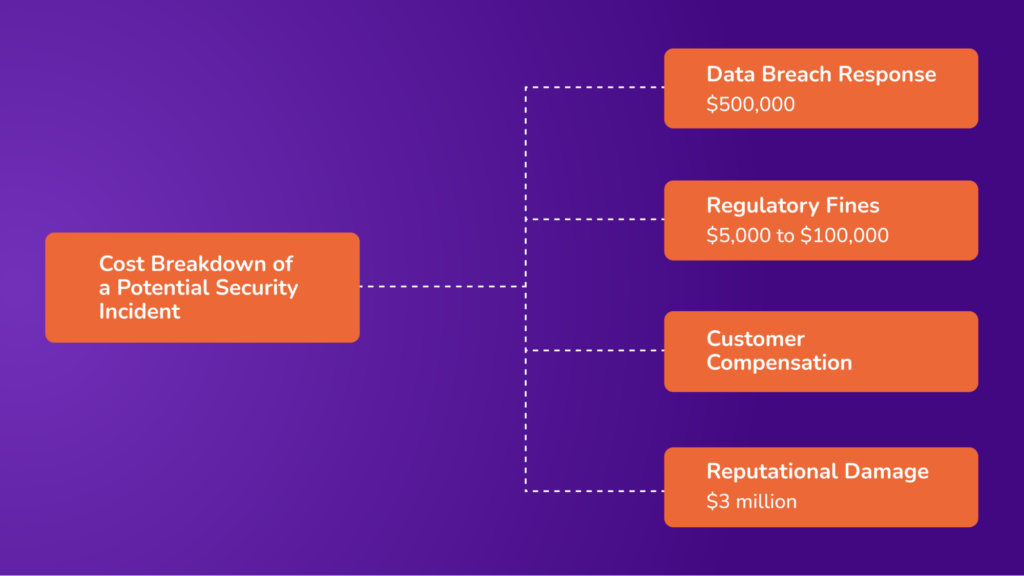

Controlled Operational Costs

Security breaches are expensive. The costs of fixing a data leak, compensating affected customers, and paying legal fees can reach millions. A PCI-compliant AI chatbot helps financial firms avoid these expenses by stopping security threats before they cause damage.

Consider the cost breakdown of a potential security incident:

- Data Breach Response – A financial firm experiences a breach due to a non-compliant AI chatbot. The cost of investigating, securing systems, and notifying customers may exceed $500,000.

- Regulatory Fines – Non-compliance with PCI DSS can result in fines ranging from $5,000 to $100,000 per month until the issue is resolved.

- Customer Compensation – If sensitive data is stolen, firms may need to reimburse affected customers, leading to additional costs.

- Reputational Damage – A breach can lead to customer loss. If 10,000 customers leave due to security concerns and each represents an average annual revenue of $300, the total loss is $3 million.

Whereas the cost of maintaining PCI DSS compliance—including AI security updates, audits, and staff training—is significantly lower than the financial impact of a single breach. Investing in proactive security measures ensures financial institutions don’t have to spend millions cleaning up after a disaster.

AI chatbots that follow PCI DSS guidelines reduce security risks, lower operational costs, and protect customer trust. Compliance is not just a legal requirement—it’s a financial strategy that helps banks and financial firms stay competitive in an era of rising cyber threats.

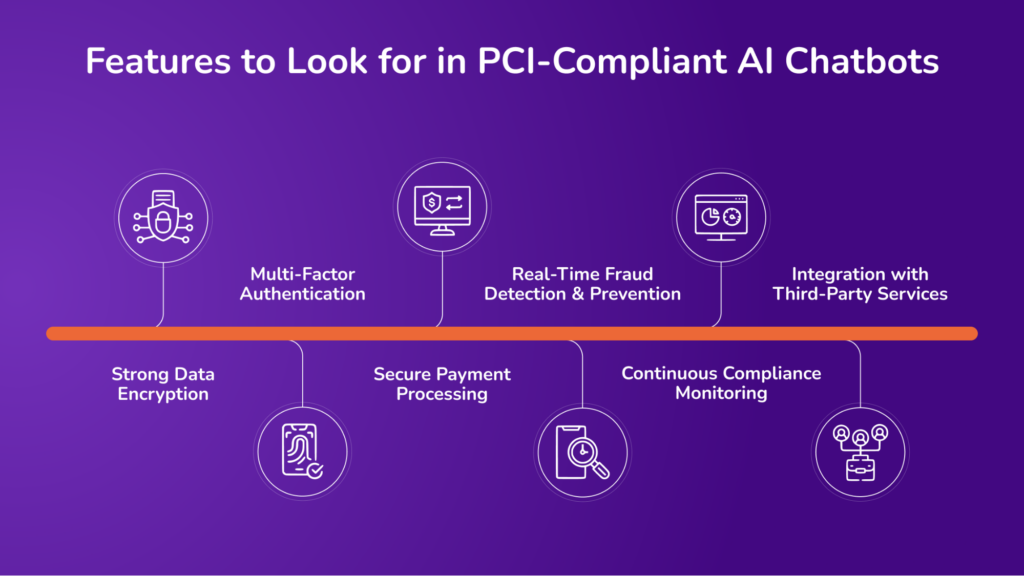

Features to Look for in PCI-Compliant AI Chatbots

Not all AI chatbots are built the same. Financial institutions must ensure their AI systems are intelligent and secure. A chatbot that lacks PCI DSS compliance can expose sensitive financial data, leaving firms vulnerable to fraud, legal action, and customer distrust.

The best AI chatbots for banking and finance go beyond basic security—they are designed to handle confidential transactions, block cyber threats, and comply with global regulations. Knowing what to look for can distinguish between a trusted AI assistant and a security liability.

1. Strong Data Encryption

Every interaction with an AI chatbot involves some level of data exchange. A compliant chatbot encrypts customer messages, transactions, and personal details using advanced encryption methods.

If a hacker intercepts the conversation, the encrypted data remains unreadable. Financial firms should look for end-to-end encryption that secures data both in transit and at rest. Without this, even simple balance inquiries can become weak points for cybercriminals.

2. Multi-Factor Authentication

Hackers often try to bypass security by impersonating legitimate users. A PCI-compliant chatbot must include multi-factor authentication (MFA) to verify identities before processing sensitive requests.

Customers may be required to confirm their identity through one-time passwords (OTPs), biometric authentication, or security questions before the chatbot grants access to account details. Without these layers of protection, fraudsters can easily manipulate AI chatbots into revealing financial data.

3. Secure Payment Processing

A PCI-compliant AI chatbot must follow strict protocols for handling payment transactions. Secure payment gateways ensure that credit card details are never stored in plain text.

The chatbot should tokenize sensitive information, replacing real card numbers with randomized tokens useless to hackers. A chatbot lacking secure payment processing can put customers and financial firms at risk of fraud and legal violations.

4. Real-Time Fraud Detection & Prevention

AI chatbots must respond to customer requests and detect fraud in real time. Advanced machine learning models analyze patterns, flagging suspicious activities before they lead to financial loss.

If a chatbot notices unusual behavior—such as multiple failed login attempts or rapid fund transfers—it should automatically block the request and notify the security team. Without built-in fraud prevention, chatbots can become easy tools for cybercriminals.

5. Continuous Compliance Monitoring

Regulatory requirements evolve, and AI chatbots must comply with the latest PCI DSS updates. A compliant chatbot should have built-in mechanisms to monitor security standards and adjust processes accordingly.

Regular audits, automated compliance reporting, and real-time security checks ensure that the chatbot continues to meet industry regulations. A static security system is vulnerable—compliance should be an ongoing effort.

6. Integration with Third-Party Services

Financial institutions rely on multiple vendors for data management, payments, and security. A PCI-compliant chatbot must safely integrate with these third-party services without exposing financial data.

Secure API connections, encrypted communications, and vendor security assessments help prevent weak links in the security chain. Banks that fail to assess third-party integrations risk exposing their systems to external threats and compliance violations.

How the Avahi Gen AI Platform Supports PCI-Compliant AI Chatbots

Financial institutions need AI chatbots that are not only smart but also secure. The Avahi AI Platform offers powerful tools to help banks improve customer service while protecting sensitive financial data. These features ensure compliance with PCI DSS and other strict regulations, reducing risks of data breaches.

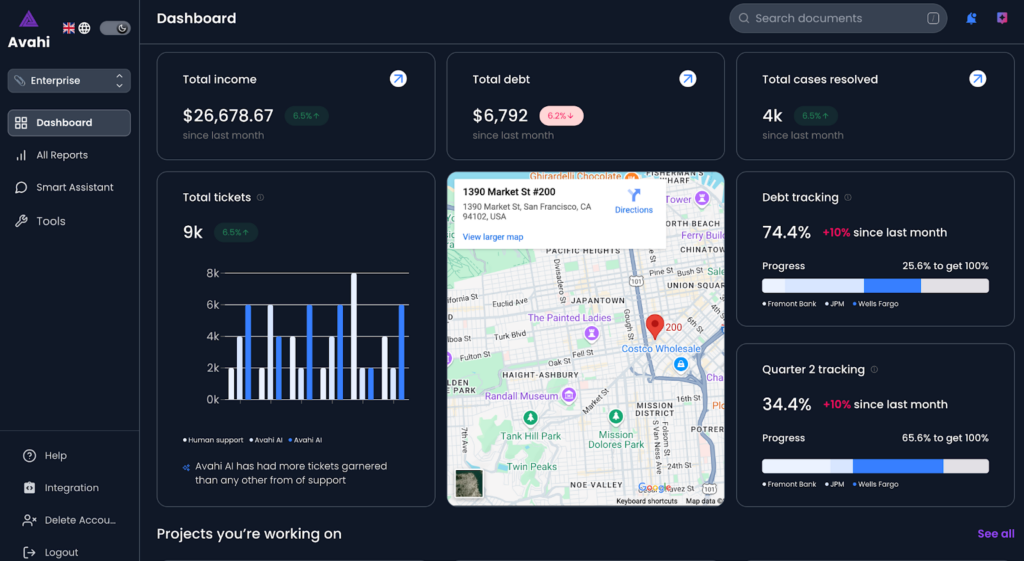

Customizable Dashboard

Banks handle vast amounts of data every day. The customizable dashboard in the Avahi Gen AI Platform helps manage this data efficiently. It tracks important business metrics, streamlines workflows, and makes scaling operations easier. With a dashboard tailored to specific needs, banks can monitor chatbot interactions, security alerts, and compliance updates in real time.

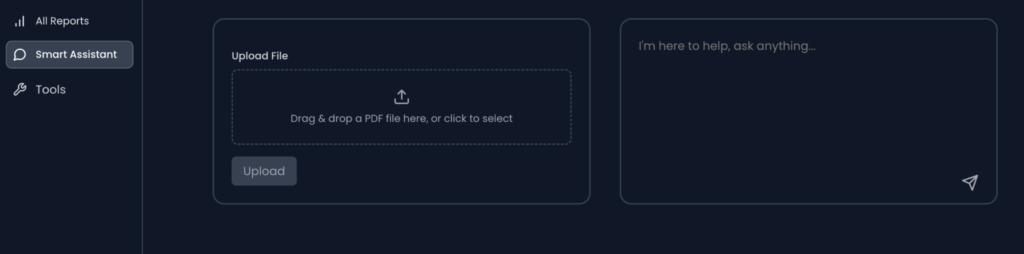

Smart Assistant

A chatbot must understand customer needs while keeping sensitive data safe. The smart assistant in Avahi Gen AI ensures smooth conversations by recognizing intent and context. For complex issues, it quickly connects customers to human agents without losing the conversation history. This creates a secure and seamless experience, ensuring no sensitive data is exposed during the transition.

Structured Data Extraction

Banks process many documents daily, from loan applications to KYC forms. The Avahi AI platform extracts important details automatically, reducing manual work and lowering the chance of errors. This feature speeds up processes like customer onboarding, compliance checks, and document verification, improving accuracy and security.

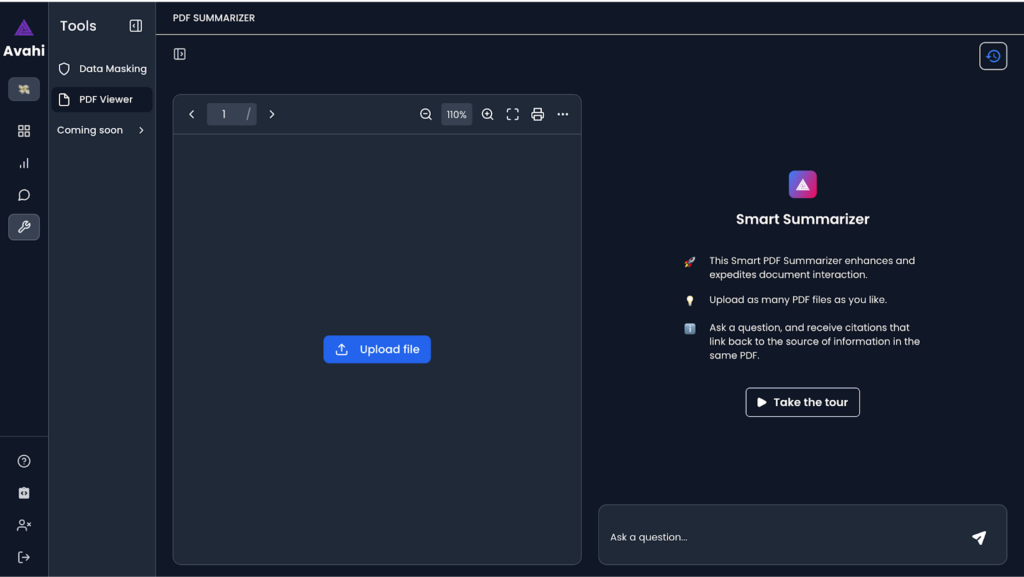

PDF Summarization

Banks often deal with multiple PDF documents containing critical financial data. Avahi’s Smart Summarizer makes handling these documents easier. Users can upload multiple PDFs, ask questions, and get clear answers with direct document citations. This improves efficiency and ensures faster decision-making without compromising security.

Data Masking and Face Recognition

Protecting customer data is crucial. Avahi’s data-masking feature automatically hides sensitive details like account numbers and transaction history during storage and processing. This prevents unauthorized access and supports compliance with laws like PCI DSS and GDPR. Face recognition adds another security layer by verifying user identity before processing high-risk transactions, reducing fraud.

CSV Querying for Instant Insights

Banks work with massive datasets, from transaction records to risk assessments. Avahi’s AI makes it easy to analyze this data. Instead of manually searching spreadsheets, teams can ask questions in natural language and get instant results. This improves decision-making and allows banks to detect suspicious activity faster.

By 2026, over 110.9 million users will interact with bank chatbots, making strong security measures more important than ever. The Avahi Gen AI Platform ensures AI chatbots in banking remain efficient, secure, and fully PCI DSS compliant, preventing data breaches while enhancing customer trust.

Discover Avahi’s AI Platform in Action

At Avahi, we empower businesses to deploy advanced Generative AI that streamlines operations, enhances decision-making, and accelerates innovation—all with zero complexity.

As your trusted AWS Cloud Consulting Partner, we empower organizations to harness AI’s full potential while ensuring security, scalability, and compliance with industry-leading cloud solutions.

Our AI Solutions Include

- AI Adoption & Integration – Utilize Amazon Bedrock and GenAI to enhance automation and decision-making.

- Custom AI Development – Build intelligent applications tailored to your business needs.

- AI Model Optimization – Seamlessly switch between AI models with automated cost, accuracy, and performance comparisons.

- AI Automation – Automate repetitive tasks and free up time for strategic growth.

- Advanced Security & AI Governance – Ensure compliance, fraud detection, and secure model deployment.

Want to unlock the power of AI with enterprise-grade security and efficiency?

Get Started with Avahi’s AI Platform!