Financial fraud is escalating at a pace that demands more innovative solutions. In 2023 alone, global fraud scams and bank fraud schemes led to projected losses of $485.6 billion. Beyond direct theft, an estimated $3.1 trillion in illicit funds, linked to crimes like money laundering, human trafficking, and terrorist financing, moved through the global financial system.

The situation is equally concerning in the U.S. Consumers reported losses of over $12.5 billion to scams in 2024, a 25% increase from the previous year. The surge in digital transactions, driven by convenience and speed, has also opened new opportunities for fraudsters.

Traditional fraud prevention methods are no longer enough. Rule-based systems and manual reviews simply can’t keep up with today’s scale and complexity. These outdated approaches often miss subtle fraud patterns or raise too many false alarms, disrupting legitimate transactions and customer trust.

This is where AI-powered financial fraud detection steps in.

AI systems can analyze millions of transactions in real time, detect hidden fraud patterns, and adapt to evolving tactics with greater accuracy and speed than manual methods. They don’t just react, they learn and improve continuously.

This blog explores how AI transforms financial fraud detection, what technologies drive it, where it’s used, how institutions benefit, and what best practices help build an effective strategy.

What is Financial Fraud and Why is it So Hard to Detect?

Financial fraud involves illegal actions meant to gain money by deception, such as using stolen payment information, creating fake or synthetic identities, misusing internal access, or laundering funds.

Common types include transactional fraud (like unauthorized card use), application fraud (opening accounts with false credentials), internal fraud (employee misuse), and synthetic identity fraud (blending real and fake data to create fake identities).

Detecting fraud is difficult due to the massive volume of daily financial transactions, constantly evolving fraud tactics, and the challenge of balancing detection accuracy, where too many false positives frustrate users and too many false negatives let real fraud go unnoticed.

What is AI in Fraud Detection and Why Does it Matter?

Artificial Intelligence (AI) in fraud detection refers to using machine learning (ML) algorithms and advanced analytics to identify suspicious patterns, anomalies, and behaviors that suggest fraudulent activity. Unlike traditional rule-based systems that rely on predefined conditions, AI systems learn from data and adapt over time.

These models analyze large volumes of data in real-time, including transaction records, user behavior, device information, and network activity. By detecting patterns that may be too complex or subtle for human analysts to notice, AI can identify fraud attempts earlier and more accurately.

Financial fraud has become more sophisticated, with criminals using advanced tools, including AI-based attacks, to evade detection. At the same time, the volume of digital transactions has increased sharply. These conditions have outpaced the capabilities of manual review processes and traditional fraud detection systems.

AI addresses these challenges by:

- Learning from data continuously improves detection accuracy over time.

- Adapting to new fraud techniques as they emerge.

- Reducing false positives by distinguishing between unusual but legitimate behavior and actual fraud.

- Scaling effectively to monitor millions of transactions in real-time.

AI’s Role in Financial Fraud Detection: From Manual Reviews to Machine Learning

The role of AI in financial fraud detection has grown significantly over time. Its development has followed a clear path, improving speed and accuracy at each stage.

1. Rule-Based Systems

Early fraud detection relied on fixed rules and manual reviews. These systems flagged transactions based on static criteria, like transaction amount or location. While helpful in catching basic fraud, they failed to adapt to complex schemes and generated many false positives, causing delays and a poor user experience.

2. Machine Learning and Behavioral Analysis

As fraud tactics became more sophisticated, machine learning models were introduced. These models could analyze large data sets and detect user behavior patterns. Learning how customers interact with digital platforms improved their ability to spot anomalies. This shift helped reduce false positives and improved the accuracy of fraud detection systems.

3. Real-Time Detection with Advanced AI

Today’s systems use advanced AI technologies, including deep learning and neural networks. These tools evaluate hundreds of data points in real-time to detect subtle signs of fraud. They assess identity and analyze user behavior and intent, making it harder for fraudsters to bypass detection. The result is faster, more accurate financial fraud detection that adapts continuously to new threats.

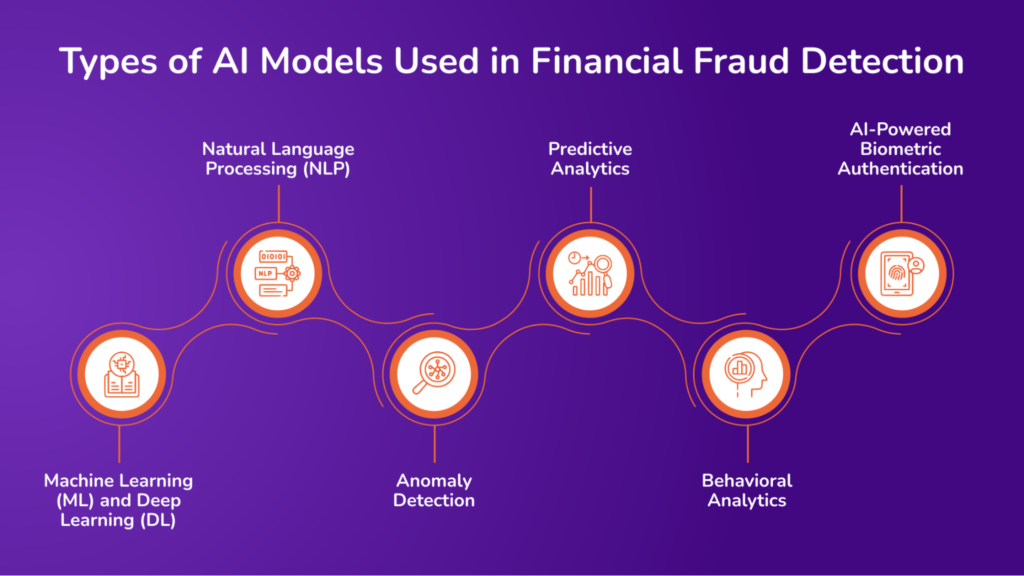

Types of AI Models Used in Financial Fraud Detection

Various AI technologies combat financial fraud, each crucial in detecting and preventing fraudulent activities. Below are the types of AI models used in financial fraud detection:

1. Machine Learning (ML) and Deep Learning (DL)

Machine learning and deep learning models analyze vast transaction data to detect fraud. These models look for patterns in how legitimate and fraudulent transactions typically occur. Once trained, they can flag suspicious activity in real-time.

ML models use two main approaches:

- Supervised learning uses labeled data, where each transaction is marked as fraudulent. The model learns to recognize patterns linked to fraud.

- Unsupervised learning looks for outliers in data without prior labels. It’s useful for detecting new types of fraud.

Neural networks, a type of deep learning, are especially effective. They can process complex relationships between transaction features, like time, amount, and location, to identify fraud patterns that are not obvious with simpler models.

2. Natural Language Processing (NLP)

NLP helps detect fraud hidden in written communication. It analyzes messages such as phishing emails, customer support chats, and application forms for red flags.

For example, NLP models can identify language used in scams or recognize attempts at social engineering. They can also review customer communications to catch signs of fraud attempts, such as urgent requests to bypass procedures or inconsistencies in application details.

3. Anomaly Detection

Anomaly detection involves spotting transactions that deviate from normal behavior. AI models use historical data to build a profile of what is “typical” for a user or account.

When a transaction falls outside this profile, such as a massive transfer or a transaction in a new country, the system flags it as potentially fraudulent. This helps catch fraud early, even when the specific method hasn’t been seen before.

4. Predictive Analytics

Predictive analytics uses past data to forecast the likelihood of fraud in future transactions. AI models assign a risk score to each transaction based on patterns observed in similar past cases.

Higher scores indicate a greater chance of fraud and trigger further review or automatic blocks. This helps financial institutions focus their efforts where the risk is highest and reduce unnecessary alerts on low-risk transactions.

5. Behavioral Analytics

Behavioral analytics tracks how users interact with financial systems over time. AI learns individual behavior patterns, such as login times, spending habits, device use, and preferred locations.

A sudden change, like logging in from a new device in a different country or making a considerable purchase, can signal potential fraud. These behavioral shifts often reveal account takeovers or compromised credentials.

6. AI-Powered Biometric Authentication

AI enhances biometric authentication systems that use fingerprints, facial recognition, and voice patterns. These technologies help verify identities more accurately than passwords or PINs.

AI can detect attempts to spoof or manipulate identity verification systems by analyzing real-time biometric data. This adds another layer of defense, especially for mobile banking and remote transactions.

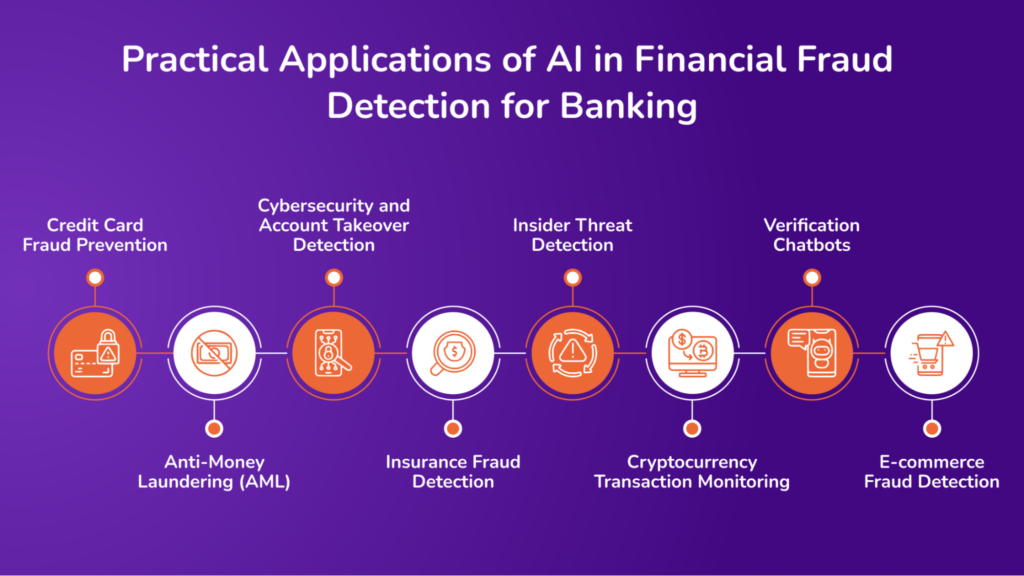

Practical Applications of AI in Financial Fraud Detection for Banking

Below are use cases where AI actively transforms banking fraud detection.

1. Credit Card Fraud Prevention

AI systems continuously monitor credit card transactions to detect signs of fraud. AI can identify anomalies indicating stolen card use by learning individual customer behaviors, such as typical spending habits, locations, and transaction times. For example, if a customer usually shops locally but suddenly makes a high-value purchase overseas, the system can block the transaction or request further verification.

For instance, American Express uses AI models, including Long-Short-Term Memory (LSTM) networks, to detect fraudulent transactions. These systems analyze customer behavior patterns to flag suspicious activity in real time. The company reported a 6% improvement in fraud detection accuracy after implementing AI-based systems.

2. Anti-Money Laundering (AML)

AI helps banks meet regulatory requirements by identifying suspicious transaction patterns linked to money laundering. These systems analyze transactions across accounts, countries, and entities to detect hidden networks or unusual financial movements. When combined with Know Your Customer (KYC) data, AI can flag transactions that appear inconsistent with a customer’s profile.

For example, HSBC uses AI to enhance its AML compliance efforts. The bank employs AI tools to analyze transactional and customer relationship data. This helps them identify hidden patterns that indicate money laundering activity, reducing manual investigations and improving reporting accuracy.

3. Cybersecurity and Account Takeover Detection

AI models detect account takeovers by monitoring login behaviors, device data, and network signals. Unusual access patterns trigger alerts, such as logging in from an unrecognized device or IP address. AI can also detect brute-force attacks, phishing attempts, and other hacking techniques used to gain control of customer accounts.

4. Insurance Fraud Detection

Banks and insurance providers use AI to validate claims by reviewing submitted documents and communication. AI tools can analyze written claims, detect inconsistencies in language, or compare image metadata to identify altered or reused evidence. Voice recognition systems can also assess tone and stress in phone calls to recognize signs of deception.

For example, Lemonade, a digital insurance provider, uses AI to review and approve claims. The system flags potentially fraudulent claims by scanning documents and checking user-submitted images and text inconsistencies. Suspicious claims are escalated for further review by human agents.

5. Insider Threat Detection

Employees with access to sensitive systems may misuse their privileges. AI tools track employee activity across systems, flagging behaviors that deviate from standard patterns, such as accessing large volumes of data at odd hours or repeatedly opening restricted files. These indicators can point to potential insider fraud or data theft.

For example, Wells Fargo has implemented AI-driven insider threat detection systems that monitor employee access to sensitive data. These systems analyze user activity to flag anomalies, such as accessing confidential customer records without valid business reasons. The bank uses this technology to reduce the risk of internal data breaches and misuse.

6. Cryptocurrency Transaction Monitoring

Due to its decentralized nature, cryptocurrency is often used in fraud schemes. AI systems can track transactions across blockchain networks, identify rapid or high-volume fund movements, and detect patterns consistent with money laundering or theft. These systems help banks and regulators improve oversight of crypto-related activity.

7. Verification Chatbots

AI-powered chatbots serve more than just customer support. They can identify suspicious language or unusual conversation patterns that suggest phishing, social engineering, or identity theft. By analyzing real-time interactions, these bots can escalate risky conversations to human agents or block attempts altogether.

For example, Bank of America’s AI assistant helps customers manage their finances by detecting fraud. The chatbot uses natural language processing to understand user intent. Erica can initiate a fraud investigation or suggest account security steps based on recognized threats if a user reports a suspicious charge.

8. E-commerce Fraud Detection

AI tools monitor customer behavior during online shopping to detect fraud. Banks use this data, such as browsing habits, purchase history, device type, and location, to flag transactions that fall outside standard patterns. The system can hold a transaction for manual review or require extra authentication. AI can also assess external websites for high-risk transactions, warning customers against potentially fraudulent online stores.

These AI use cases show how the technology strengthens financial fraud detection across multiple areas. By automating monitoring, learning from behavior, and acting in real-time, AI allows financial institutions to prevent fraud more effectively while minimizing disruption to legitimate customers.

Building a Strong Financial Fraud Detection System: Best Practices for Compliance and Risk Management

Below are best practices to help organizations build a strong and effective AI fraud detection strategy.

1. Build an Integrated Fraud Prevention Team

Assembling teams from various departments is crucial for a successful fraud detection strategy. Involve experts from IT, data science, legal, compliance, and customer service. The technical team can focus on developing and optimizing AI models.

In contrast, the business and customer-facing teams offer valuable insights into real-world patterns, ensuring that the fraud detection system aligns with technical and operational requirements.

2. Maintain Ongoing System Evaluation and Improvement

Fraud techniques evolve rapidly, so it’s essential to continually assess your fraud detection system’s performance. Regular activities should include reviewing fraud attempts trends, tracking detection models’ accuracy and performance, and updating the models with fresh, relevant data. This ongoing process ensures the system adapts to new tactics and remains efficient.

3. Strengthen Security with Multiple Layers

For maximum effectiveness, additional security layers should complement AI-based fraud detection. Implement measures such as adaptive authentication methods that adjust based on risk, device fingerprinting for identifying unknown devices, and multi-factor authentication for sensitive transactions. A layered security strategy creates multiple checkpoints, making it harder for fraudsters to bypass the system.

4. Choose Scalable Fraud Detection Tools

Selecting the correct fraud detection tools is critical to ensuring efficiency and effectiveness. Focus on fraud detection accuracy and reducing false alarms, real-time response capabilities to address threats as they arise, and scalability to handle increasing transaction volumes. Both powerful and flexible tools will provide long-term protection without compromising operational speed.

5. Prioritize Privacy and Data Protection

Adhering to data protection laws such as GDPR and CCPA is essential when handling sensitive customer information. Ensure compliance by collecting only necessary data and encrypting and securing user data at all stages. Being transparent with customers about how their data is used

Ethical data management fosters trust and helps avoid legal complications.

6. Conduct Regular Simulation-Based Testing

Regularly test your fraud detection system by simulating real-world fraud attempts. Both internal and external penetration testing help identify vulnerabilities before fraudsters can exploit them. These proactive exercises ensure your system is prepared to respond to evolving threats.

7. Collaborate with External Experts and Industry Peers

Engage regularly with cybersecurity professionals, consultants, and industry peers to share insights, research, and fraud detection techniques. By staying connected with external sources, institutions can access new intelligence, gain early warnings of emerging fraud trends, and improve their internal fraud detection strategies.

How Does the Avahi GenAI Platform Enforce Fraud Detection Compliance?

The Avahi AI Platform provides AI-powered features to enhance data security, streamline compliance workflows, and support organizations in meeting compliance requirements. Here’s how Avahi’s specific features align with fraud detection compliance standards:

Data Masking

Avahi’s Data Masker tool helps mask sensitive data, such as Primary Account Numbers (PANs), ensuring that only authorized personnel can access complete cardholder information.

Enforcing the principle of least privilege reduces the risk of unauthorized access to sensitive financial data. This ensures that employees or systems can only view the data necessary for fraud detection tasks, maintaining operational efficiency while enhancing data security during fraud investigations.

Smart Summarizer

AvahiGen AI’s ability to process and extract content from .txt, .doc, and .pdf files supports the discovery of unprotected PANs (Primary Account Numbers) across multiple file formats.

When paired with features like Smart Summarizer, this capability enables automated content review and aids in identifying unencrypted cardholder data. This proactive data visibility enables security teams to quickly identify unencrypted or improperly stored data, making it easier to detect non-compliant practices and prevent data breaches that could lead to financial fraud.

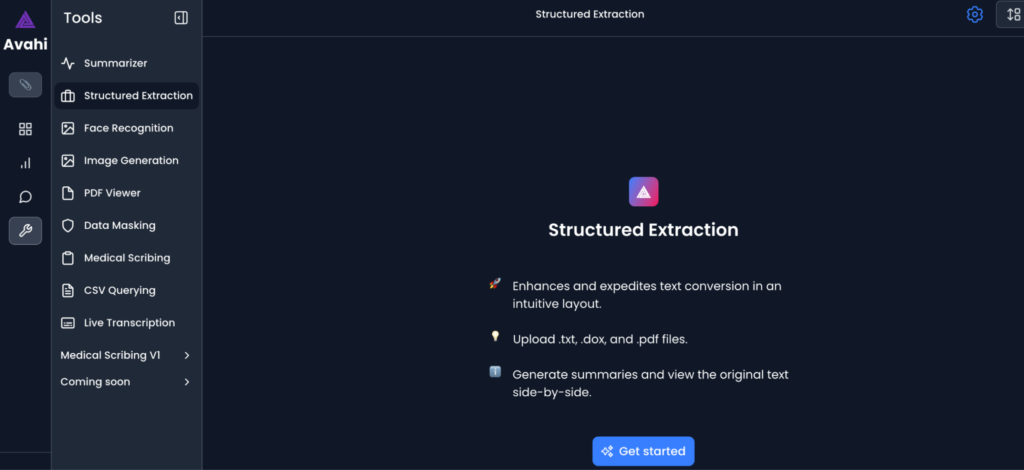

Structured Extraction

AvahiGen’s Structured Extraction capability enables rapid processing and categorizing of documents like KYC forms, loan applications, and compliance records. In the event of a suspected breach, this tool supports the incident response process by quickly surfacing relevant data for investigation, reducing time to resolution, and enhancing audit traceability.

It reduces response time and improves audit traceability, ensuring that fraud incidents are addressed promptly and in line with compliance requirements.

Role-Based Access Control

Features like Data Masker and Structured Data Extraction imply configurable access management, where different user roles can perform specific operations on data (e.g., view summaries, query CSVs, or mask sensitive elements).

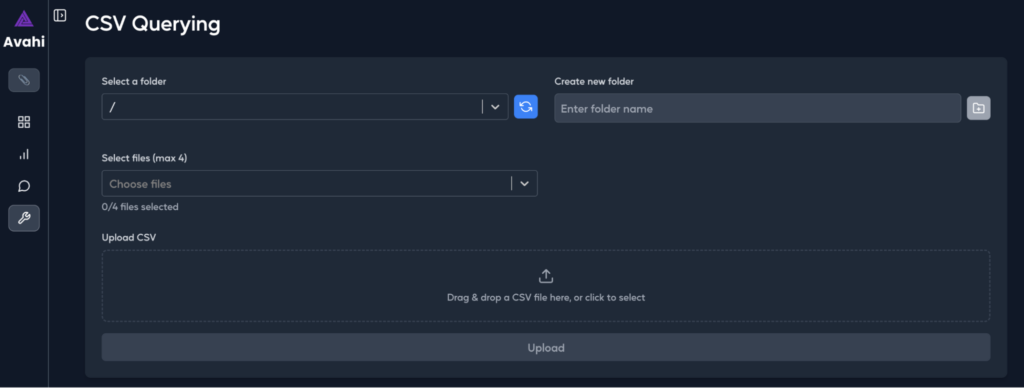

Natural Language Querying for CSVs

With CSV Querying, compliance and risk teams can analyze transactional data or customer records using a secure, AI-assisted interface. This reduces reliance on manual scripts or direct database access, which often carry security risks.

Using an AI-assisted interface, teams can perform fraud analysis without direct access to raw data, minimizing security risks. This controlled, simplified interface supports fraud detection analytics while maintaining strict access controls, reducing manual scripts or direct database access vulnerabilities.

Discover Avahi’s AI Platform in Action

At Avahi, we empower businesses to deploy advanced Generative AI that streamlines operations, enhances decision-making, and accelerates innovation—all with zero complexity.

As your trusted AWS Cloud Consulting Partner, we empower organizations to harness AI’s full potential while ensuring security, scalability, and compliance with industry-leading cloud solutions.

Our AI Solutions include

- AI Adoption & Integration – Utilize Amazon Bedrock and GenAI to enhance automation and decision-making.

- Custom AI Development – Build intelligent applications tailored to your business needs.

- AI Model Optimization – Seamlessly switch between AI models with automated cost, accuracy, and performance comparisons.

- AI Automation – Automate repetitive tasks and free up time for strategic growth.

- Advanced Security & AI Governance – Ensure compliance, fraud detection, and secure model deployment.

Want to unlock the power of AI with enterprise-grade security and efficiency? Get Started with Avahi’s AI Platform!