The financial industry generates massive volumes of data every second. Banks, insurers, and investment firms constantly collect information from customer transactions and market shifts to track risk metrics and compliance logs.

Regular data analysis methods, built on static models and manual processes, can no longer keep up with this scale, speed, or complexity.

This is where AI-driven data analysis comes in.

By combining artificial intelligence (AI), machine learning (ML), and advanced analytics, financial institutions can now turn raw data into real-time, actionable insights. These technologies don’t just automate tasks; they enhance decision-making, reduce operational risks, and unlock new growth opportunities.

AI models can detect fraud in milliseconds, predict credit risk more accurately, and personalize services for millions of customers simultaneously.

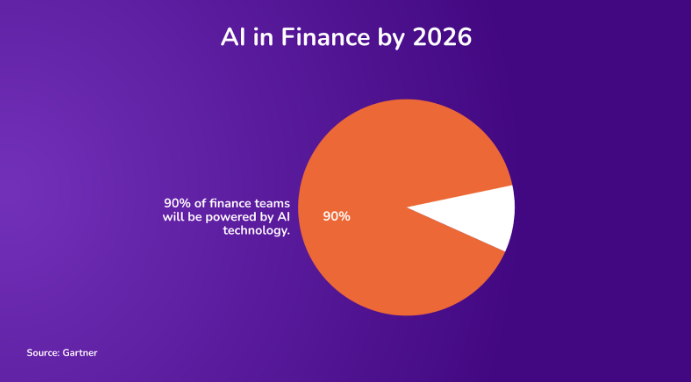

Gartner predicts that by 2026, 90% of finance departments will have implemented at least one AI-powered technology solution. McKinsey further estimates that AI could deliver up to $1 trillion in annual value to the global banking industry alone.

The shift is already reshaping how financial institutions manage risk, serve clients, and remain competitive. This blog explores what AI-driven data analysis means in finance, why it matters, and how organizations are applying it across functions to adopt AI responsibly and effectively.

AI-Driven Data Analysis in Finance: What It Is and Why It Matters

AI-driven data analysis in finance refers to the use of artificial intelligence (AI) and machine learning (ML) technologies to automate, enhance, and accelerate the processing, evaluation, and interpretation of financial data. It empowers financial institutions to efficiently handle vast volumes of data, uncover critical insights, and improve decision-making accuracy and speed.

Regular analytics often rely heavily on historical data and manual intervention, which limits their ability to provide timely and actionable insights. AI-driven analytics, however, can instantly process and analyze complex, dynamic financial data from multiple sources. It significantly improves the efficiency, accuracy, and decision-making capabilities of financial institutions.

Essential Components of AI-Driven Data Analysis

Below, we will discuss the essential components that power AI-driven data analysis and explain how each contributes to making smarter financial decisions.

1. Machine Learning (ML)

Machine learning is a specialized subset of AI that uses algorithms capable of learning and improving automatically from data. ML algorithms analyze historical data patterns to predict future financial trends, assess risks, and automate decisions without explicit programming for every scenario.

- Supervised Learning: Trained with labeled historical financial data to predict outcomes, such as loan approvals or stock prices.

- Unsupervised Learning: Identifies hidden patterns or segments within financial data, valid for fraud detection and customer segmentation.

- Reinforcement Learning: Continuously improves decision-making strategies through trial-and-error interactions, optimizing trading strategies or portfolio management.

2. Deep Learning (DL)

Deep learning, a subset of ML, utilizes neural networks that simulate human brain functions to analyze complex and large-scale financial datasets. It’s particularly effective for tasks such as credit scoring, algorithmic trading, and identifying subtle patterns that indicate financial fraud.

3. Natural Language Processing (NLP)

NLP enables AI systems to interpret, analyze, and generate human language, significantly streamlining tasks such as sentiment analysis of financial news, automatic report generation, or reviewing compliance documents.

AI vs. Traditional Analytics in Finance: A Comparative Overview

As financial institutions adopt AI on a large scale, the limitations of traditional analytics become increasingly evident. While legacy systems rely on static models and manual processes, AI-powered analytics deliver real-time, adaptive, and highly accurate insights. Below is a structured comparison of AI-powered analytics and traditional analytics across key performance dimensions.

| Aspect | Traditional Analytics | AI-Powered Analytics |

| Data Handling | Limited to structured data; struggles with unstructured or large-scale datasets. | Easily handles structured, unstructured, and large-scale data from diverse sources. |

| Speed & Responsiveness | Focuses on historical data; often lags behind real-time events. | Analyzes live data streams in real-time, enabling instant response to market changes. |

| Scalability | Scaling requires manual intervention and additional resources. | Scales seamlessly with minimal overhead using cloud and automation technologies. |

| Accuracy & Bias | Prone to human error and biased assumptions; limited adaptability. | Continuously learns and improves; reduces bias and increases accuracy over time. |

| Usability | Requires specialized analysts for interpretation. | Offers user-friendly interfaces and NLP features, accessible to non-technical users. |

| Adaptability | Static models require frequent manual updates and recalibration. | Learns from new data and automatically adapts to changes in patterns or behavior. |

| Insight Type | Provides descriptive or diagnostic insights (what happened and why) | Delivers predictive and prescriptive insights (what’s likely to happen and what to do). |

| Decision Support | Supports reactive decision-making based on past trends. | Enables proactive, forward-looking strategies based on real-time data. |

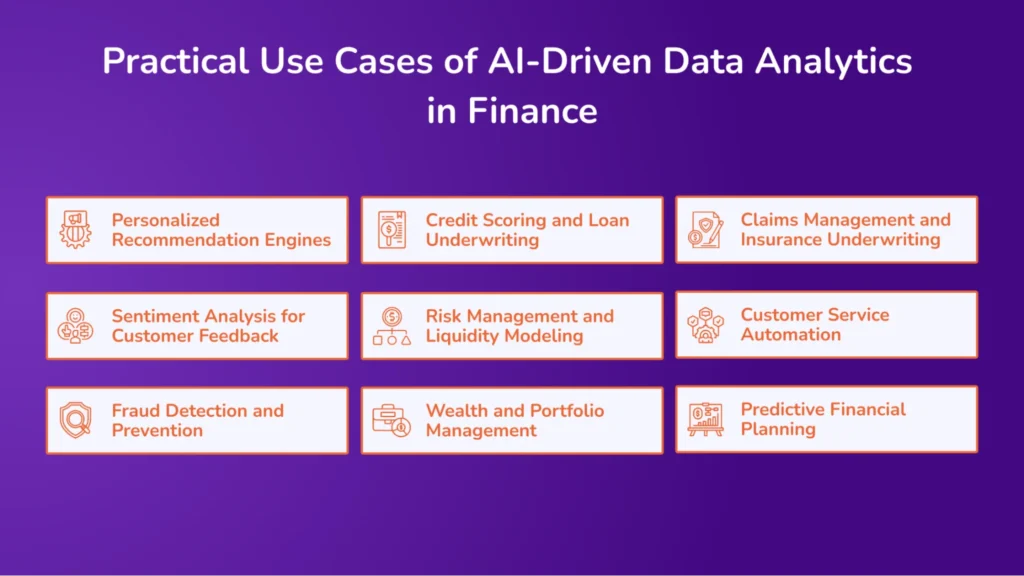

Practical Use Cases of AI-Driven Data Analytics in Finance

Artificial intelligence (AI) and machine learning (ML) have reshaped how financial institutions operate, shifting from static reporting to real-time, predictive, and prescriptive insights. Below are the most impactful applications of AI-driven data analytics in the finance sector:

1. Personalized Recommendation Engines

Recommendation systems use AI to analyze user behavior, including spending patterns, content preferences, and browsing activity, to deliver personalized suggestions for financial products.

According to a study by McKinsey, personalization, aided by machine learning, boosts customer engagement by up to 80% in the financial services industry. Personalized experiences drive higher engagement and loyalty. This type of engine uses technologies such as collaborative filtering, content-based filtering, and reinforcement learning.

For example, Morgan Stanley’s WealthDesk models provide real-life client scenarios to inform investment strategies based on milestones, such as having a child, using AI.

2. Sentiment Analysis for Customer Feedback

AI-powered sentiment analysis helps financial institutions assess public opinion and client satisfaction in real time. Using natural language processing (NLP), these systems analyze data from social media, emails, surveys, chat logs, and customer service calls.

According to Gartner, generative AI, digital customer service tools, and conversational user interfaces (CUIs) are set to reshape customer service and support by 2028. Financial companies deal with millions of customer touchpoints. In AI-driven customer sentiment analysis, technologies like Natural Language Processing (NLP) are combined with supervised learning models, such as Support Vector Machines (SVMs) and BERT-based models, to interpret and classify customer feedback accurately.

For example, Capital One uses AI to improve customer experience by analyzing service interactions, helping it streamline responses and improve satisfaction scores.

3. Fraud Detection and Prevention

AI analytics can detect fraud in real time by analyzing patterns in transaction and biometric data. ML models flag anomalies that static, rule-based systems would miss.

Financial fraud is becoming increasingly sophisticated, fast-moving, and expensive for institutions to manage. To combat this, AI-powered fraud detection systems use advanced technologies such as neural networks, anomaly detection algorithms, Naïve Bayes classifiers, and decision trees. These tools allow organizations to identify suspicious activities in real-time with a high degree of accuracy.

According to Forrester, machine learning-based fraud detection can also lower false positive rates by up to 70% compared to conventional rule-based approaches, significantly reducing operational overhead.

4. Credit Scoring and Loan Underwriting

According to Accenture (2024), AI-driven credit scoring can boost approval rates by up to 30% while simultaneously lowering the risk of defaults, making lending both more inclusive and more accurate. ML-driven analytics enables smarter, faster, and fairer credit decisions. These models evaluate a wider range of variables beyond the standard credit score.

Conventional credit scoring models often rely on narrow, outdated criteria, which can restrict financial inclusion and overlook creditworthy individuals. To address this, financial institutions are turning to advanced machine learning techniques such as gradient boosting models, decision forests, and neural networks. These models are enhanced by incorporating alternative data sources, such as rental payments, utility bills, and employment history, to provide a more holistic view of an applicant’s creditworthiness.

For example, Fifth Third Bank implemented a custom ML model that utilizes this broader dataset and saw a 10% increase in credit approval rates.

5. Risk Management and Liquidity Modeling

AI analytics helps banks model risk exposure based on real-time macroeconomic indicators, customer behavior, and transactional trends.

Poor liquidity risk management has led to high-profile bank failures. AI-driven risk analytics offers a more robust solution by leveraging predictive analytics, Monte Carlo simulations, and stress-testing frameworks that operate on real-time data feeds. These technologies enable institutions to assess potential risks more accurately and proactively. 85% of financial institutions using AI for risk modeling report faster identification of systemic risks.

6. Wealth and Portfolio Management

AI tools help advisors develop personalized investment strategies and improve self-service tools for retail investors. Investors expect faster, data-driven advice that matches their goals and risk tolerance.

Technologies like generative AI, robo-advisors, and rule-based asset allocation models make it possible to deliver this level of service on a large scale. For instance, Morningstar has introduced an AI assistant called “Mo,” which helps advisors quickly access deep investment research and make better-informed decisions.

This kind of innovation is gaining widespread trust. According to Deloitte (2024), 90% of financial advisors believe that AI can help grow their business by at least 20% in the coming years.

7. Claims Management and Insurance Underwriting

AI enhances insurance by automating risk evaluation and speeding up claims processing using visual and structured data. Manual insurance processes are time-consuming and prone to error.

According to McKinsey, AI can also cut the time it takes to resolve claims by up to 75%, leading to better customer satisfaction and more efficient operations. AI is transforming how insurance companies handle claims and underwriting by making the process faster and more accurate.

Technologies like computer vision are used to assess damage from images, while natural language processing (NLP) helps analyze written claims. Supervised learning models then evaluate the risk and make quick decisions.

A great example is the partnership between Hiscox and Google, where they built an AI-powered tool that reduced the time needed to generate property insurance quotes from days to just minutes.

8. Customer Service Automation

According to Gartner, up to 80% of customer interactions in the financial sector can now be automated using AI tools, making support faster, more efficient, and always available.

AI-driven chatbots handle routine queries, reducing the burden on customer service teams while providing 24/7 support. Quickly resolving basic customer issues is fundamental to delivering a better overall experience, and AI-powered chatbots make that possible.

These chatbots use machine learning-based natural language processing (NLP) to understand questions, classify intent, and respond appropriately within context.

9. Predictive Financial Planning

According to Harvard Business Review, AI-driven financial planning has been shown to boost savings rates by up to 15% for retail customers. AI predicts future financial needs based on life events, income, spending, and goals, providing tailored savings or investment advice.

Many people put off important financial decisions because they don’t have clear guidance. AI is helping solve this by offering personalized financial planning based on each person’s habits and goals. It uses tools like time-series forecasting to predict future needs, clustering to group people by similar financial behaviors, and behavioral modeling to suggest the right actions.

For example, Morgan Stanley is developing a GPT-powered assistant that can recommend tax-saving tips or inheritance planning steps right after a client meeting.

How AI Tackles Scalability Challenges in the Financial Sector?

AI-driven analytics significantly enhance scalability in financial institutions by efficiently managing large volumes of complex data. The following key aspects illustrate how AI solves scalability challenges effectively:

1. Efficient Data Management and Integration

AI automates the collection, integration, and cleaning of financial data from various sources. Through AI-powered Extract, Transform, Load (ETL) processes, data from diverse formats, such as transactional records, market data, and customer interactions, is quickly standardized and consolidated. Cloud-based AI platforms further enhance scalability by providing flexible, on-demand resources that manage growing data volumes without significant hardware investments.

For example, financial institutions utilize AI-driven ETL processes to integrate transaction data, customer profiles, and market feeds seamlessly into unified analytical platforms, simplifying complex data management tasks.

2. Real-time Data Processing and Analysis

AI algorithms rapidly process and analyze continuous data streams, allowing financial institutions to derive insights instantaneously. This real-time analysis capability is crucial in sectors such as high-frequency trading, market risk management, and fraud detection, where even slight delays can have significant financial impacts.

For instance, algorithmic trading firms use real-time AI analytics to quickly evaluate market conditions, identifying profitable opportunities or emerging risks instantly, which is crucial for gaining a competitive advantage and mitigating risk.

3. Improved Decision-making

AI-driven predictive analytics transforms vast datasets into actionable insights, enabling financial institutions to more accurately anticipate market trends, customer behavior, and risk exposure.

Machine learning models learn from historical data, reducing human biases and errors, thus providing highly accurate and objective forecasts. Banks can use AI-based predictive models to more precisely forecast loan default rates, leading to better-informed lending decisions and reduced financial risk.

How AI Enhances Compliance in Finance Sector?

AI-driven analytics addresses complex regulatory compliance challenges effectively in the finance sector by automating critical processes and ensuring accurate, real-time monitoring. Here are some of the essential ways in which AI improves compliance:

1. Automated Regulatory Reporting

AI significantly simplifies regulatory reporting by continuously tracking and analyzing transaction data. Advanced AI tools monitor transactions in real-time, identifying anomalies or suspicious activities that might indicate non-compliance or fraudulent behavior. Automated monitoring reduces manual effort, enhances accuracy, and ensures timely submission of regulatory documents.

For instance, AI-driven systems instantly flag unusual financial activities, streamlining Anti-Money Laundering (AML) reporting, which allows financial institutions to meet regulatory requirements promptly without delays or errors.

2. Proactive Risk Management and Mitigation

AI-powered predictive models identify and proactively manage compliance risks. These models analyze historical and real-time data to detect patterns indicating potential regulatory violations, enabling financial institutions to anticipate and address compliance issues before they escalate.

Continuous compliance tracking also provides real-time alerts, helping organizations respond swiftly to emerging risks. Banks use predictive risk modeling to proactively assess credit, market, or operational risks, ensuring timely intervention and reduced regulatory penalties.

3. Data Privacy and Security Enhancement

AI plays a crucial role in safeguarding sensitive financial data, helping institutions meet stringent data privacy laws such as GDPR. AI solutions actively detect vulnerabilities and prevent data breaches through advanced threat detection methods.

Additionally, AI-powered data anonymization and encryption ensure that data privacy standards are consistently met, safeguarding customer trust and regulatory compliance. For example, AI-driven encryption tools dynamically anonymize customer data, ensuring that personal information remains protected while enabling financial analysis and reporting activities.

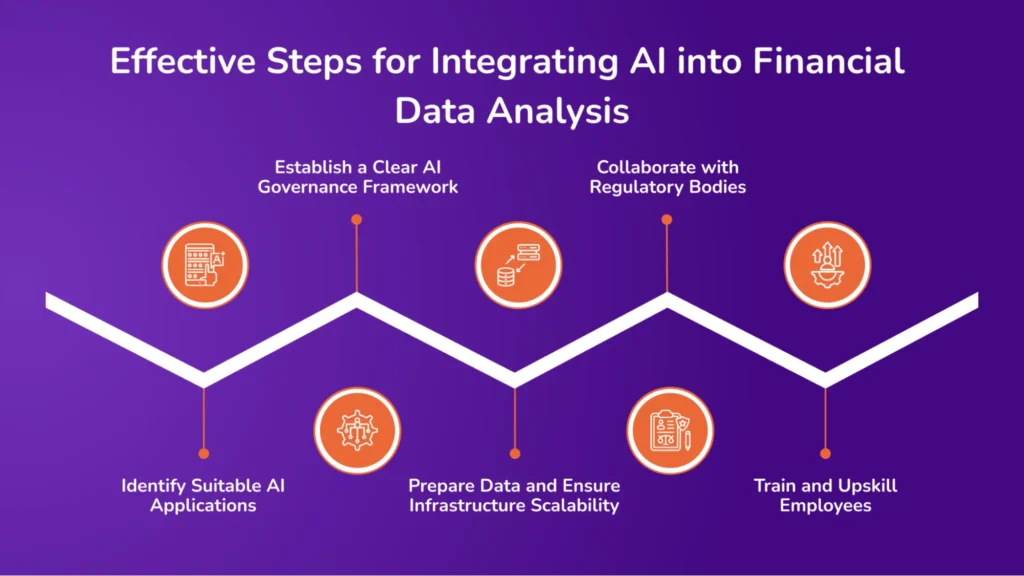

Effective Steps for Integrating AI into Financial Data Analysis

Successfully integrating AI into financial data analysis requires careful planning and clear steps. Financial institutions can follow these structured guidelines to ensure effective AI adoption:

1. Identify Suitable AI Applications

Begin by clearly understanding your organization’s specific requirements and challenges. Evaluate key areas such as fraud detection, credit scoring, customer analytics, risk management, and compliance monitoring.

Choose AI solutions that directly align with these needs to ensure measurable results and efficient resource utilization. Conduct a thorough internal assessment to identify processes that will most benefit from AI-driven analytics.

2. Establish a Clear AI Governance Framework

Define clear policies and guidelines for AI use within your organization. Develop an ethics framework that outlines responsible AI practices, data privacy considerations, and transparency requirements. A robust governance framework ensures compliance with regulations, reduces operational risks, and builds trust with stakeholders.

Formulate AI governance guidelines that clearly detail usage policies, data privacy standards, and ethical considerations, and communicate them effectively across the organization.

3. Prepare Data and Ensure Infrastructure Scalability

Ensure data readiness by standardizing and cleaning your existing datasets. Confirm data quality, accuracy, and completeness, as high-quality data is essential for practical AI analysis. Additionally, develop a scalable technology infrastructure that utilizes cloud-based platforms or flexible systems to handle growing data volumes without performance loss.

Implement robust data management practices, including data cleansing, integration, and migration to scalable cloud infrastructures.

4. Collaborate with Regulatory Bodies

Proactively engage with relevant regulatory authorities to align AI initiatives with legal and compliance requirements. Early collaboration ensures your AI systems meet current regulatory standards and anticipates changes to avoid future compliance issues.

Transparent communication with regulators also supports smoother adoption of AI. Regularly communicate your AI implementation strategies with compliance and regulatory authorities to maintain alignment with evolving regulations.

5. Train and Upskill Employees

Equip your team with the necessary skills and knowledge to effectively leverage AI-driven tools. Provide comprehensive training programs focused on AI fundamentals, analytics interpretation, and practical application.

Enhancing your team’s AI proficiency promotes effective adoption, encourages informed decision-making, and maximizes the value derived from AI analytics. Develop structured training initiatives and continuous learning opportunities that empower employees to use and understand AI technologies proficiently.

Transforming Financial Operations: How the Avahi GenAI Platform Drives Scalability and Compliance

The Avahi AI Platform offers AI-powered features to enhance data security, streamline compliance workflows, and help organizations meet compliance requirements. Below is a breakdown of how specific features align with relevant requirements.

Data Masking

The Data Masker feature masks the sensitive data from users who do not need access to complete cardholder information.

This enforces the principle of least privilege, ensuring that employees or systems only access the data necessary for their role. Data Masker de-identifies information in real time and enables secure role-based data views without compromising operational efficiency.

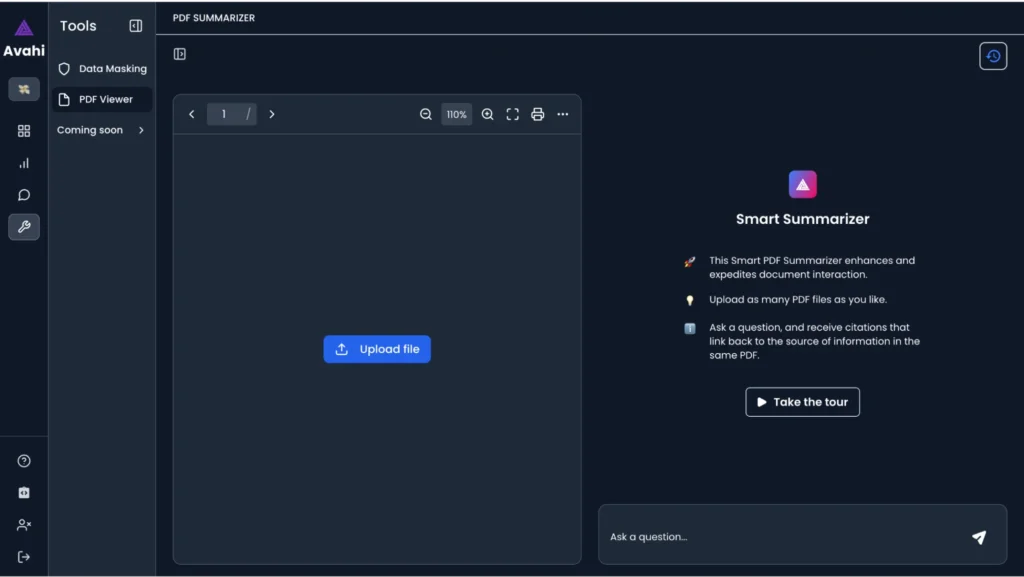

Smart Summarizer

AvahiGen AI’s ability to process and extract content from .txt, .doc, and .pdf files supports the discovery of unprotected PANs (Primary Account Numbers) across multiple file formats.

When paired with features like Smart Summarizer, this capability enables automated content review and aids in identifying unencrypted cardholder data. This proactive data visibility helps security teams detect and remediate non-compliant storage or transmission practices.

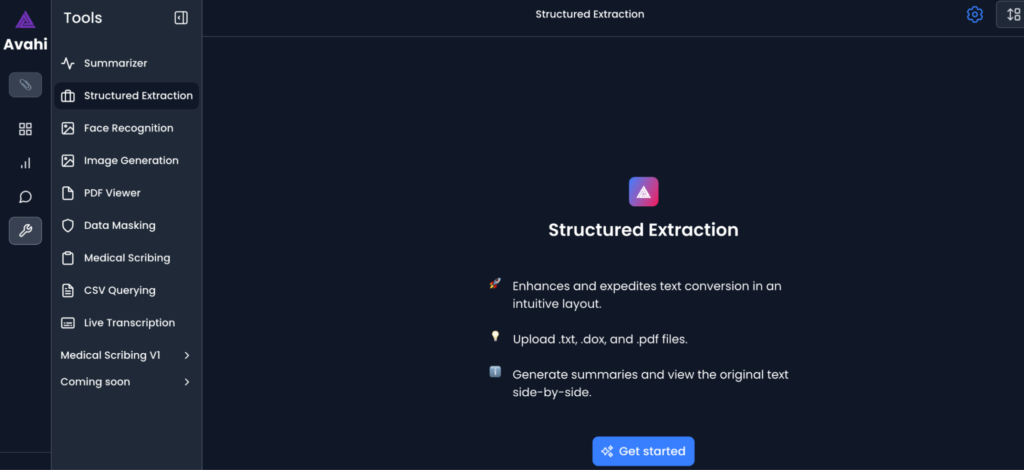

Structured Extraction

AvahiGen’s Structured Extraction capability enables rapid processing and categorizing of documents like KYC forms, loan applications, and compliance records. In the event of a suspected breach, this tool supports the incident response process by quickly surfacing relevant data for investigation, reducing time to resolution, and enhancing audit traceability.

This helps meet the requirement for a well-documented, testable, and ready-to-deploy incident response process.

Role-Based Access Control

Features like Data Masker and Structured Data Extraction imply configurable access management, where different user roles can perform specific operations on data (e.g., view summaries, query CSVs, or mask sensitive elements). This aligns with compliance expectations for fine-grained access control and operational accountability.

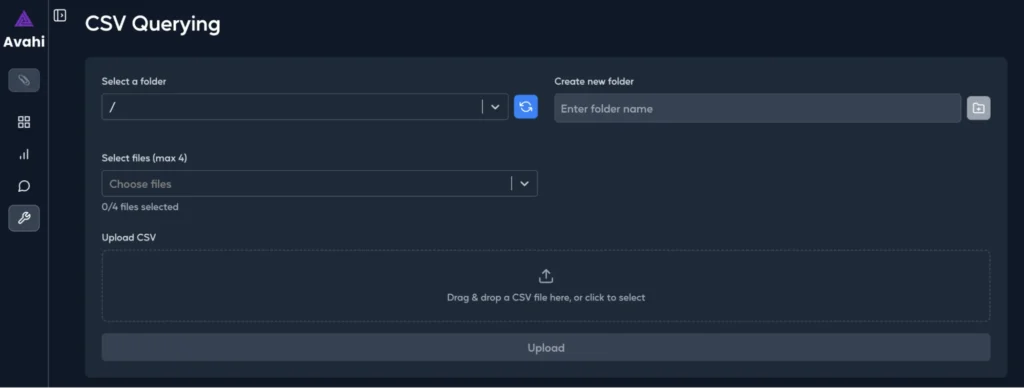

Natural Language Querying for CSVs

With CSV Querying, compliance and risk teams can analyze transactional data or customer records using a secure, AI-assisted interface. This reduces reliance on manual scripts or direct database access, which often carry security risks.

The simplified, controlled interface supports secure analytics without exposing raw data to unnecessary users, reducing development overhead, and minimizing security vulnerabilities.

Discover Avahi’s AI Platform in Action

At Avahi, we empower businesses to deploy advanced Generative AI that streamlines operations, enhances decision-making, and accelerates innovation—all with zero complexity.

As your trusted AWS Cloud Consulting Partner, we empower organizations to harness AI’s full potential while ensuring security, scalability, and compliance with industry-leading cloud solutions.

Our AI Solutions include

- AI Adoption & Integration – Utilize Amazon Bedrock and GenAI to enhance automation and decision-making.

- Custom AI Development – Build intelligent applications tailored to your business needs.

- AI Model Optimization – Seamlessly switch between AI models with automated cost, accuracy, and performance comparisons.

- AI Automation – Automate repetitive tasks and free up time for strategic growth.

- Advanced Security & AI Governance – Ensure compliance, fraud detection, and secure model deployment.

Want to unlock the power of AI with enterprise-grade security and efficiency? Get Started with Avahi’s AI Platform!

Frequently Asked Questions

- How does AI help financial institutions scale efficiently?

AI streamlines data collection, processing, and analysis across departments, eliminating manual bottlenecks. It enables institutions to manage growing volumes of customer and transactional data without adding headcount. Real-time insights help teams respond faster to market changes, leading to leaner operations and scalable growth.

- Can AI improve compliance in the finance sector?

Absolutely. AI tools automatically track transactions, flag anomalies, and generate regulatory reports. They help enforce data privacy with encryption and role-based access, ensuring institutions meet standards like GDPR and AML. By reducing manual errors and delays, AI strengthens compliance and audit readiness.

- Beyond fraud detection, where is AI most valuable in finance?

AI enhances key areas like credit scoring, customer personalization, portfolio management, and sentiment analysis. It allows for faster, more inclusive lending decisions and real-time client support. Institutions use AI to tailor financial advice, streamline workflows, and deliver better user experiences.

- What are the key challenges when adopting AI in finance?

Institutions often face data silos, a lack of skilled talent, and unclear AI governance. Without clean, reliable data or proper oversight, AI systems can underperform or pose compliance risks. Successful adoption requires upfront investment in infrastructure, training, and responsible AI policies.

- How does Avahi’s AI Platform support compliance and scalability?

Avahi offers features like Data Masker, Smart Summarizer, and Structured Extraction to automate secure data handling. These tools help institutions control access, find hidden compliance risks, and speed up document review. As a result, teams scale faster while staying aligned with evolving regulations.