What if one missed alert could cost your bank millions?

That’s not hypothetical. In 2023, global banks paid over $6.7 billion in fines for compliance failures, mostly tied to Anti-Money Laundering (AML), data privacy breaches, and fraud. And as regulatory frameworks become broader and more complex, that number is only expected to grow.

Banks today operate in a high-stakes environment where regulations are increasing in volume and evolving rapidly across different jurisdictions. For banks, the challenge is clear: you need to monitor transactions in real time, verify customer identities with precision, and maintain controls that can hold up under scrutiny, every hour of every day.

The problem?

Regular compliance models are still largely manual. Teams are buried in data, combing through spreadsheets and reports, reacting instead of preventing. It’s slow, fragmented, and vulnerable to human error.

This is where Artificial Intelligence (AI) becomes essential. Artificial Intelligence can scan vast datasets in seconds, spot risks before they escalate, and automate repetitive tasks that drain time and energy.

The result? Faster decisions, stronger oversight, and a system that can scale with your regulatory demands. And the shift is already happening. McKinsey & Company forecasts that generative AI will transform financial risk management over the next five years, automating everything from daily compliance operations to complex risk scenarios like climate exposure.

In this blog, we’ll explore how AI Redefines regulatory compliance in banking and helps banks build faster, smarter, and more resilient compliance systems.

Essential Compliance Requirements for Banks

Regulatory compliance is a critical function in the banking sector. As financial systems expand globally and digital transactions become more common, the regulatory environment has grown more complex. Banks are required to maintain compliance across the following regulatory areas:

Anti-Money Laundering (AML)

Banks must monitor and report suspicious activities that may involve the movement of illicit funds. This includes identifying unusual transaction patterns and maintaining robust reporting systems.

Know Your Customer (KYC)

Financial institutions are required to verify customers’ identities and assess their risk profiles. KYC processes are essential for preventing identity theft, financial fraud, and terrorism financing.

Fraud Detection

Institutions need systems to detect unauthorized transactions, account takeovers, and internal misconduct. Effective fraud detection relies on continuous monitoring and rapid response to threats.

Data Privacy Laws

Regulations such as the GDPR, the Gramm-Leach-Bliley Act, the California Consumer Privacy Act, and similar frameworks mandate how customer data is collected, stored, and shared. Banks must ensure transparency, consent, and protection of personal information.

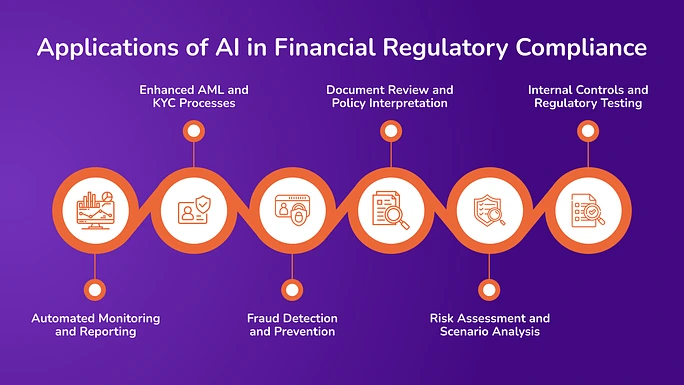

Applications of AI in Financial Regulatory Compliance

Artificial Intelligence is quickly becoming a core part of how U.S. financial institutions approach regulatory compliance. Below are essential areas where AI is making a significant impact:

1. Automated Monitoring and Reporting

AI facilitates continuous oversight of banking operations, replacing manual audits with dynamic, real-time systems. AI models analyze transactions as they occur, identifying anomalies based on patterns, thresholds, and contextual data. This allows immediate detection of potential compliance violations. According to an IBM study, Generative AI enables more accurate and specific responses through advanced prompting techniques.

AI systems generate alerts based on risk scoring and behavioral analysis. These alerts adapt to new trends, reducing false positives and improving accuracy.

Natural Language Processing (NLP) tools generate and validate regulatory reports by scanning and summarizing structured and unstructured data, ensuring consistency and reducing human errors. AI tools maintain traceable records of compliance actions, aiding internal reviews and external audits with time-stamped, immutable logs.

For example, the Commonwealth Bank of Australia implemented an AI-powered alert and investigation management system, replacing 12 separate applications. This system enhances the bank’s ability to detect and investigate financial crimes efficiently.

2. Enhanced AML and KYC Processes

AI significantly improves the efficiency and effectiveness of Anti-Money Laundering (AML) and Know Your Customer (KYC) activities. AI-based document recognition and facial-matching technologies verify customer identities through biometric analysis and optical character recognition (OCR), reducing onboarding time and fraud risk.

Machine learning models track user behavior to identify deviations that might indicate illicit activities. AI adapts real-time risk scores, incorporating new data from transactions and third-party sources and ensuring compliance with risk-based approaches.

AI tools continuously update customer data and check against sanction lists, politically exposed persons (PEPs), and adverse media using NLP and data scraping from global sources. For example, DBS Bank in Singapore utilizes AI to streamline credit processing operations, automate the assessment of credit applications, and improve customer experience.

3. Fraud Detection and Prevention

AI strengthens fraud prevention through advanced analytics and real-time insights. Machine learning algorithms use historical fraud cases to recognize potential future fraud, identifying hidden correlations in transaction data.

AI assesses behavior across channels to detect inconsistencies, such as sudden changes in transaction volume or location mismatches. It integrates data from various channels to develop a comprehensive risk profile, enhancing fraud detection across customer touchpoints.

For example, JPMorgan Chase employs AI to detect suspicious transactions, reducing fraud by 90% and saving the bank $100 million annually.

4. Document Review and Policy Interpretation

AI reduces the burden of manual review by extracting regulatory obligations and aligning them with internal policies. AI-powered NLP engines scan regulatory documents to extract obligations, deadlines, and required actions. AI systems map new regulations to the bank’s existing controls and policies, identifying gaps and suggesting updates.

Instead of searching line by line, users can ask targeted questions (e.g., Does this policy meet GDPR standards?), and AI will locate and present the relevant excerpt with contextual reference. This makes it easier to verify regulatory alignment.

AI tools track changes across document versions and notify compliance teams about updates, ensuring nothing is missed. They also support multilingual document analysis for global banks and compare compliance requirements across jurisdictions.

5. Risk Assessment and Scenario Analysis

42% of financial institutions deploy AI in stress testing and scenario analysis. AI enhances risk evaluation and forecasting by running simulations and analyzing financial health in real time. AI models simulate various economic and regulatory scenarios to test a bank’s resilience.

AI continuously recalculates capital buffers, factoring in real-time exposure and market movements. The tools evaluate exposure concentrations across asset classes and geographies, aiding in precise risk management. They forecast potential compliance risks or operational disruptions using historical and current data. AI can simulate the impact of regulatory changes before implementation, aiding in proactive planning.

According to McKinsey, generative AI could add between $200 billion and $340 billion in value annually to the global banking sector, mainly through increased productivity and enhanced risk management.

6. Internal Controls and Regulatory Testing

Banks are constantly under regulatory scrutiny, and internal controls are evaluated to ensure compliance, risk mitigation, and operational integrity. AI supports this by automating and improving internal controls’ design, testing, and validation.

AI can analyze an institution’s Risk and Control Matrix (RACM) and determine whether controls adequately mitigate risks such as fraud, AML/KYC violations, or data privacy breaches. AI systems can flag signs of ineffective controls, such as a lack of segregation of duties, inadequate monitoring/reporting, weak access/security controls (e.g., passwords), missing documentation, untrained personnel, and limited oversight or review loops.

Instead of relying on periodic manual reviews, AI enables continuous monitoring and testing of internal controls, improving accuracy and response time.

Strategic Benefits of AI in Compliance Management

Integrating Artificial Intelligence (AI) in compliance functions reshapes how financial institutions manage regulatory obligations. Below are the benefits of AI in compliance management:

Improved Accuracy and Consistency

AI reduces the reliance on manual inputs, which are prone to human error and inconsistencies, especially across large-scale or complex operations. AI-powered systems can analyze structured and unstructured data with high precision, ensuring that regulatory standards are applied uniformly.

Continuous Monitoring and Real-Time Alerts

AI enables real-time surveillance of transactions, behaviors, and controls beyond what traditional systems can manage. Instead of periodic manual audits, AI ensures continuous compliance monitoring across systems and departments. This real-time monitoring also strengthens fraud prevention and AML protocols, reducing the window for undetected violations.

Faster Adaptation to Regulatory Changes

One of the biggest challenges in compliance is keeping up with shifting regulations across multiple jurisdictions. AI models can scan thousands of regulatory sources, legal updates, and compliance bulletins to identify relevant changes and suggest timely policy updates.

Cost Efficiency and Resource Optimization

AI significantly cuts operational costs by automating repetitive compliance tasks and improving process efficiency. Examples include automating PBC list management, document verification, reporting, and control design assessments.

McKinsey estimates that digital transformation in financial services can reduce compliance-related costs by 20–30%. This frees staff to focus on complex decision-making, audits, and strategic risk management.

Enhanced Risk Management

AI excels at detecting unusual patterns in transactional data, user behavior, or control processes, strengthening early fraud detection. Machine learning models can flag outliers and anomalies quickly, reducing financial loss and reputational damage.

The Association of Certified Fraud Examiners (ACFE) notes that organizations using proactive data monitoring with AI reduce fraud losses by up to 50%. AI also supports advanced risk modeling and scenario analysis, helping firms prepare for potential threats more effectively.

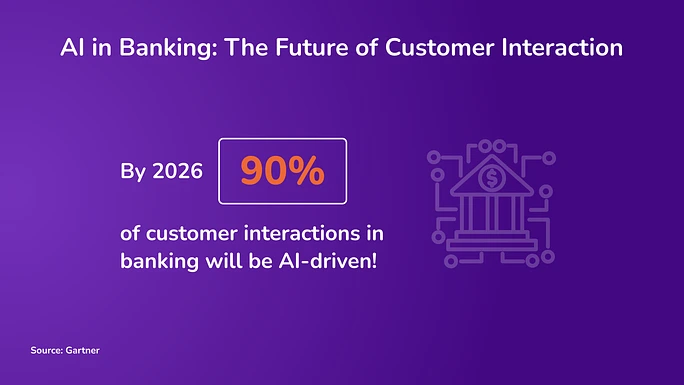

Improved Customer Experience

Efficient compliance processes improve customer onboarding, speed up approvals, and minimize wait times, which are essential to customer satisfaction. AI enables automated KYC and AML checks, faster identity verification, and quicker dispute resolution.

Gartner reports that AI-powered customer service solutions can enhance productivity, improve customer experience, and reduce costs. Streamlined processes also reduce documentation errors, enhancing transparency and trust with customers.

How Can Your Organization Streamline Compliance Processes with Avahi’s GenAI?

The Avahi AI Platform provides AI-powered features to enhance data security and streamline compliance workflows. Below is a breakdown of how specific features align with relevant requirements.

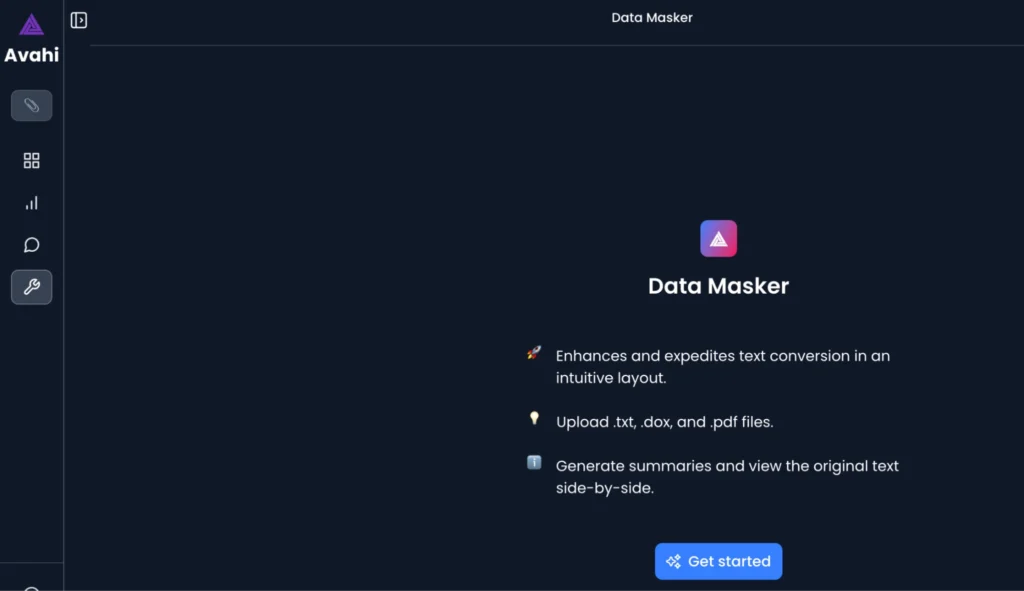

Data Masking

The Data Masker tool supports compliance by masking PCI-sensitive data from users who do not need access to complete cardholder information.

This enforces the principle of least privilege, ensuring that employees or systems only access the data necessary for their role. Data Masker de-identifies information in real time and enables secure role-based data views without compromising operational efficiency.

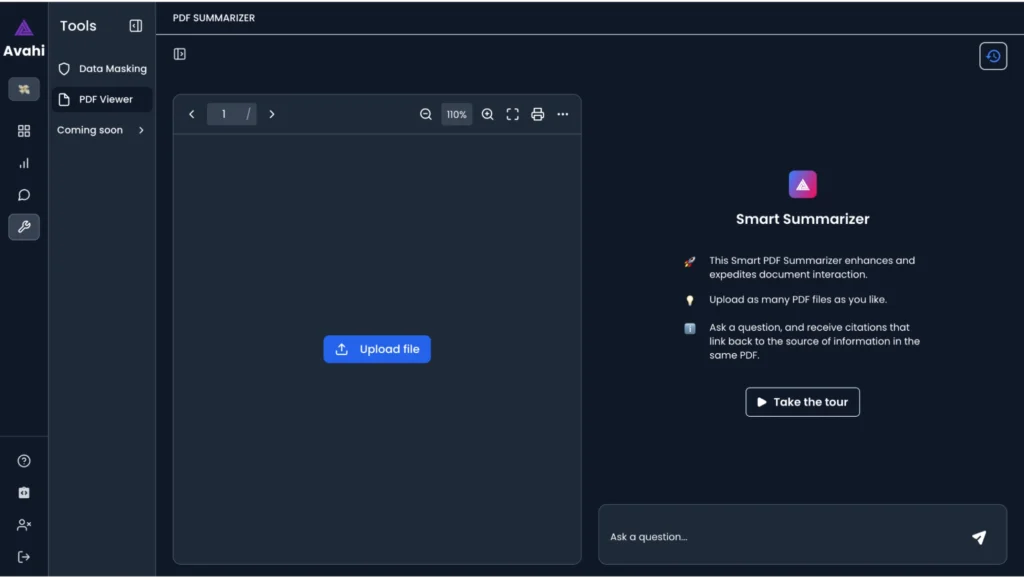

Smart Summarizer

AvahiGen AI’s ability to process and extract content from .txt, .doc, and .pdf files supports the discovery of unprotected PANs (Primary Account Numbers) across multiple file formats.

When paired with features like Smart Summarizer, this capability enables automated content review and aids in identifying unencrypted cardholder data. This proactive data visibility helps security teams detect and remediate non-compliant storage or transmission practices.

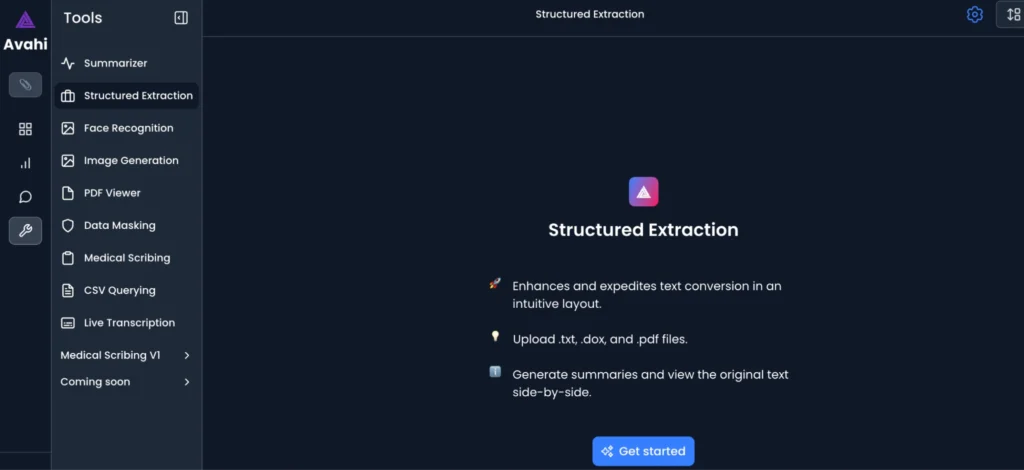

Structured Extraction

AvahiGen’s Structured Extraction capability enables rapid processing and categorizing of documents like KYC forms, loan applications, and compliance records. In the event of a suspected breach, this tool supports the incident response process by quickly surfacing relevant data for investigation, reducing time to resolution, and enhancing audit traceability.

This helps meet the requirement for a well-documented, testable, and ready-to-deploy incident response process.

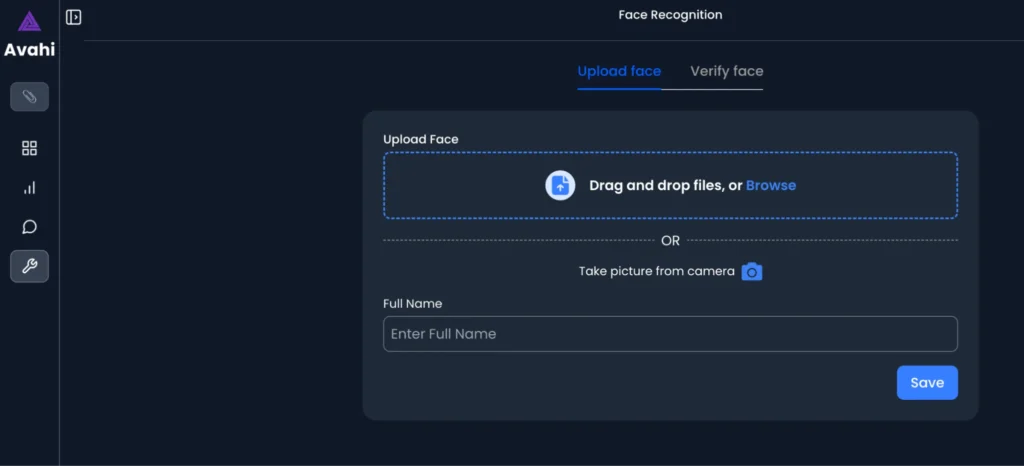

Face Recognition

Avahi AI’s face recognition feature helps verify identities quickly and accurately. It uses facial analysis to match a person’s face with their official records or documents. This process allows banks and other organizations to confirm that the person is who they claims to be, reducing the risk of identity fraud.

The system is designed to be intuitive, making it easy for users to complete verification without technical support. Avahi AI helps streamline onboarding and improve security by automating identity checks through face recognition.

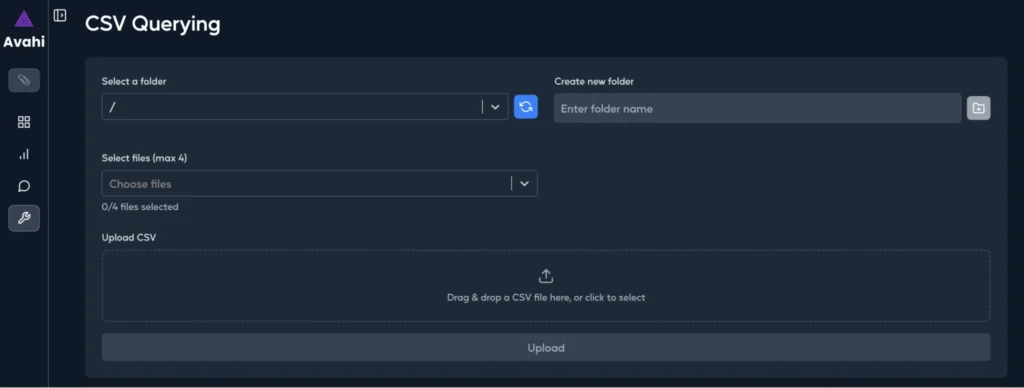

Natural Language Querying for CSVs

With CSV Querying, compliance and risk teams can analyze transactional data or customer records using a secure, AI-assisted interface. This reduces reliance on manual scripts or direct database access, which often carry security risks.

The simplified, controlled interface supports secure analytics without exposing raw data to unnecessary users, reducing development overhead, and minimizing security vulnerabilities.

Discover Avahi’s AI Platform in Action

At Avahi, we empower businesses to deploy advanced Generative AI that streamlines operations, enhances decision-making, and accelerates innovation—all with zero complexity.

As your trusted AWS Cloud Consulting Partner, we empower organizations to harness AI’s full potential while ensuring security, scalability, and compliance with industry-leading cloud solutions.

Our AI Solutions include:

- AI Adoption & Integration – Utilize Amazon Bedrock and GenAI to enhance automation and decision-making.

- Custom AI Development – Build intelligent applications tailored to your business needs.

- AI Model Optimization – Seamlessly switch between AI models with automated cost, accuracy, and performance comparisons.

- AI Automation – Automate repetitive tasks and free up time for strategic growth.

- Advanced Security & AI Governance – Ensure compliance, fraud detection, and secure model deployment.

Want to unlock the power of AI with enterprise-grade security and efficiency? Get started with Avahi’s Gen AI Platform!